Just enjoy the show!!

The Government finally decided to take the bears by the horns (wait a sec, do bears have horns – oh well, by the paws then). The FM today announced a sharp cut in nominal corporate income tax rate to around 25% from around 35% – however, the various exemptions given to companies also stand withdrawn along with the new tax rate. Further, a subsidized tax rate of 15% has been introduced for new manufacturing units. The equity markets reacted sharply – up around 5.5% during the day and 2% for the week. The markets and economy go together in the long run but this action may have a divergent impact – great for markets but may not count for much for the economy. We discuss the fundamental economic equation – government spending will be constrained as a result of revenue forgone due to lower corporate tax collections, but the government is hoping corporate capex/investments pick up, and so do jobs market. The case study of US does not indicate material pick-up in capex/investments, but corporate USA profits went up and so did the equity markets. Enjoy the show – while it lasts – at least for a few months. We take out our negative bias on Indian equity markets and go neutral.

References (writesup in the series) :

https://determinedinvest.wordpress.com/2019/09/10/the-credit-crisis-sep19-update/

https://balablogsdotcom.wordpress.com/2019/07/06/fudget-nothing-to-do-with-budget-2019/

https://determinedinvest.wordpress.com/2018/12/17/a-few-battles-won-but-risks-losing-the-war/

- What difference does a day make? Well we always keep telling investors to take a long term view of the markets, sometimes ourselves forgetting that a week is also a long time in the markets. Figure 1 presents of the story of Indian equity/share markets this week. After falling around 3.5% during the first four days of the week, the market jumped 5.5% on Friday (today) to close the week up 2%. So what happened – the Government of India for the last three weeks has been coming out with small measures to stabilize the slowing economy. This time they came out with a big gun – the FM Mrs. Sitharaman announced sweeping changes to corporate income tax in the morning. In particular, the nominal corporate tax rate has been reduced to around 25% from around 35%. It doesn’t take a genius to figure out lower tax rates means higher profits for companies – even though the effective tax rate in India (around 30%) is much below the nominal rate. Hence the sharp reaction. The Government estimates the benefit to be worth Rs1.45L cr (US$20bn).

GDP = Consumption + Investment + Government + (Exports – Imports)

- Great for markets, what about the economy. The economy and the markets go together – well at least in the long run, and that is the basis of our macro-investment themed wealth plan. However, in the short run, there can be divergence between the economy and the market. The government action is definitely good for corporate India and the market. However, an assessment of the fundamental economic equation raises some questions. The easy one first – Net Exports (Exports – Imports) are unlikely to be impacted much given the announcement is not targeted towards trade/exports. Consumption also has very weak correlation to corporate income tax – surely there will be some companies passing on the benefit, but cutting GST was the way to go if the government wished to push consumption. By foregoing part of the revenue, the government is also limiting its ability to spend – thus Government part of the GDP equation will be a drag. The part of the GDP equation the government hopes will make up for the shortfall is corporate Investment, and jobs. One of the key elements of the recent economic slowdown has been slowing corporate Investment (in factories, in offices etc, and hence in jobs) – this has been very clearly visible in the Auto sector for example. To the extent the capex/corporate Investment cycle restarts, the job losses will also moderate, also helping stabilize the Consumption side of the GDP equation. The trillion dollar question is whether the C+I gains make up for the G losses, in the equation.

- This is a tough one to answer immediately. The economy is a complex beast that unfortunately cannot be reduced down to a single equation (although equations such as the above do help to understand what is going on, and how things could change). Here is why we are skeptical the government actions will have a major impact. Corporate India can be broadly divided into three elements – Consumer sector (investment-lite), BFSI (Banking and Finance – investment-lite) and Infrastructure and manufacturing (investment-heavy). The thing with investment heavy industries is that they already enjoy a lot of income tax exemptions, with their effective tax rate being below 30% (the details we will get in some time) – the government has cut the tax rate but it will be applicable to only if companies that are willing to forgo the tax exemptions they currently enjoy. Hence there is not much benefit to investment heavy industries. The government has allowed an even lower 15% tax rate for new manufacturing units (the most sensible part of the announcements) but this benefit is not available to existing units/companies. Actually even the capital-lite Consumer and BFSI sectors can pass on the benefit of lower taxes to the Consumer in the form of lower prices/higher discounts driving Consumption. But they did not do so during the GST implementation (our very first writeup) and it is unclear to us how much of the benefit would be passed through to Consumers now.

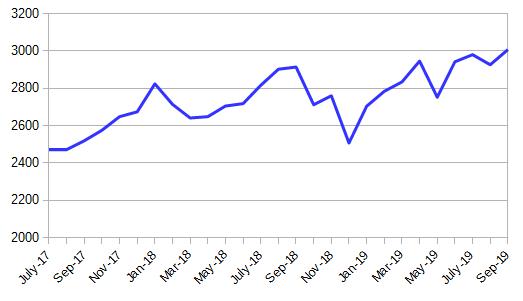

- Case Study – US and the Trump tax cuts of 2017. Interestingly the action in India is very similar to the US tax cuts under their new president Donald Trump in 2017. The Tax Cuts and Jobs Act was proposed by President Trump in Sep 2017 and came into effect in Dec 2017. Like the Indian Government action today, there were multiple facets to the US tax cuts (including cut in personal income tax rates) but the cornerstone was the reduction in corporate tax rate to 21% from 35%. Figure 2 presents the US economic growth in this decade. The problem with all economic data is it is very difficult to construct a base case – how much of the impact is due from the tax cuts and what would have been the economic growth without them. At any rate, we can see the US economic growth improving to around 3% in 2019 from around 2% in 2018 (assumed base case). Although at the high end of the range (1.5-3% since 2010), this was nowhere near 4-6% claimed by President Trump. And the impact was only for one year as growth moderated in 1H19 – although other variables such as US-China Trade War have played a part. But the US stock market did well (Figure 3). Between July 2017 to Jan 2018, S&P 500 advanced/gained a solid 14%. However, the performance thereafter (6% gain in last 20 months) was not inspiring. Corporate USA did not increase its capex/ investments materially as hoped by the US government – majority of the profits gains went back to share-holders/ investors in the form of buybacks/dividends (Figure 4). Hence also the positive impact on the equity market. The US jobs market has held up well but started from a position of stability (in 2017). Given the sharp economic slowdown from 7+% levels to 5% in 1QFY20, India has already seen job losses (in a few industries like auto at any rate). Hence India is coming from a somewhat more challenging position hence stability in economic growth and jobs market may be potential positives.

https://www.marketwatch.com/story/its-official-the-trump-tax-cuts-were-a-bust-2019-01-30

- Bottomline (for investors that have had so much patience). Very clearly the impact on the equity market has been (in case of US) and is expected (in case of India) to be positive. So why fly against the wind (at least for the next few months). By that time we will also see the reaction of corporate India (similar to US, or if capex/ investments actually pick up). Then we can revisit the question of whether the Indian economy will actually recover or continue to muddle along. That is, of course, unless something else comes along the way to rock the apple cart. Just enjoy the show – while it lasts – for as long as it does!!

Pingback: In Review – Week 38, 2019 | Determined investments

Pingback: In Review – Week 39, 2019 | Determined investments

Pingback: Macro Window – India today | Determined investments

Pingback: The India equity/risk Nov19 update | Determined investments

Pingback: What plans for Spring! | Determined investments

Pingback: Save the economy, not some money | Determined investments

Pingback: The India Equity/ Risk Mar21 update | Determined investments

Pingback: The India Equity/ Risk Sep21 update | Determined investments