Symphony Ltd

Never confuse a Bull Market with Brains

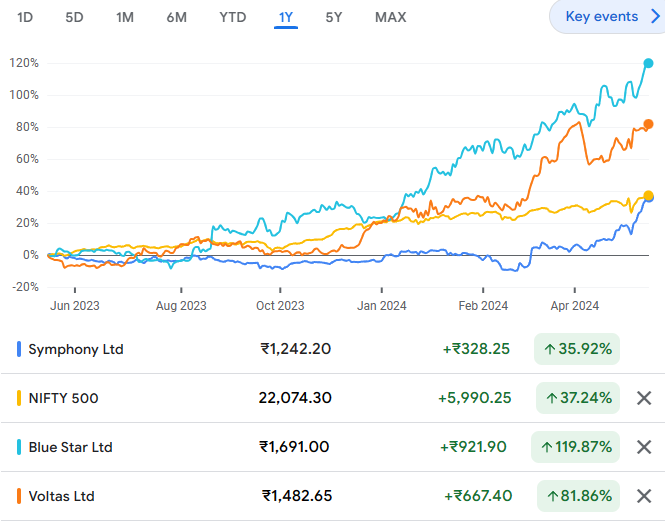

Really Symphony Ltd needs no introduction – it is the brand name synonymous with Air Coolers in India. In another era, when most ‘respectable’ HVAC companies used to prefer to work in Air Conditioning and Industrials segment, completely leaving the younger brother Air Cooler segment to ‘unorganized’ players, came Symphony. Led by innovative products, good quality and advertising, it captured 50+% share of the Air Cooler market in India – the rest, as they say, is history (then again, so is Xerox). Figure 1 presents the robust returns in the stock over the last year, yet it is hardly an outlier (vs the Nifty500 Index). In this case even FY24 profits have seen growth over FY23 (Figure 2). So why have we picked this company/ stock for our series today? Because we realized the series was becoming very heavy on Industrials/ B2B – when the reality is (in our view) that the Consumer/ B2C stocks are also in the same irrational bull market. To appreciate this in Symphony’s context, see its financial performance over the last 5 years (from pre-Covid to post) – Sales flat and profits down over 5 years! This when Air Coolers is an growing segment with still only 15-20% penetration among Indian homes (ACs have another 10-15% penetration). The answers to Symphony’s problems is (extreme competition). Once the core HVAC companies (Voltas, Blue Star, others) realized the Air Cooler opportunity set, they were falling over themselves to launch their own Air Cooler products. But they are not alone – Electrical Appliances companies (Havells, Crompton, Bajaj, others) have joined them. Symphony claims they continue to hold 50% share of the India Air Coolers market – we believe they have lost at least 10+% (likely more) share of the market. And continue to… quite nice (really lovely) for a stock presently trading at ‘only’ 60X P/E valuation.

Everything happens for a reason. Looking at the broader HVAC segment, all the stocks have performed quite strongly ytd-2024. Take note that this segment is majorly a seasonal/ Summer segment (with a small trail opportunity during festival season also). Summers 2021-22 were lost to Covid (Waves 1-2 exactly coincided with Summers). Summer 2023 was lost to unseasonal rains in Apr-23, reducing the sale season. Hence Summer 2024 is the first normal sale season we are witnessing in the post-Covid era. Blue Star/ Voltas were valid investible ideas in 2023 – post the sharp rally, they are not today. Of course this is our view, and as always take your own counsel.